(To learn more about the benefits of becoming a Non-Resident Importer (NRI), click here.)

What is a Business Number?

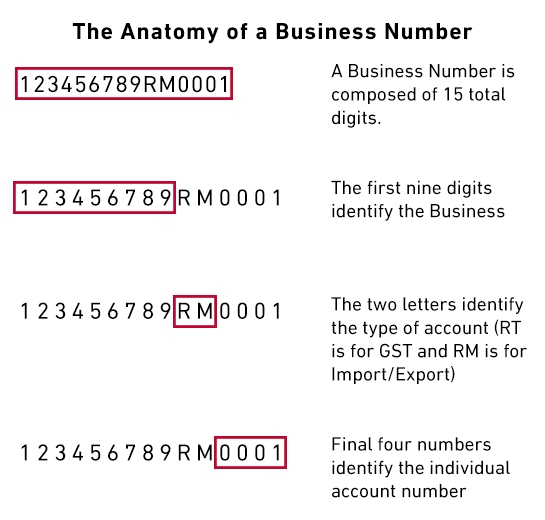

A Business Number (BN) provides businesses with a 15 digit number which the Canadian Revenue Agency (CRA) uses for business accounts. The two important accounts for NRIs are the Goods and Services Tax / Harmonized Sales Tax (GST/HST) program account, and the Import/Export program account.

A BN is used by the Canadian government to identify your business, allowing you to conduct all your CRA interactions with a single contact. There are two fundamental reasons why you need a BN if you want to be an NRI:

Your BN Lets You Import Into Canada

There’s no getting around it: You need a business number if you want to act as an NRI when you ship your goods into Canada. Applying for a BN will let you apply for an Import-Export program account used by the Canadian Government, and gives you the option to become the Importer of Record, which is the party responsible for clearing the goods through customs. The Importer of Record is normally the buyer or the seller.

Your BN Lets You Register For A GST/HST Account

Obtaining a BN does NOT automatically mean you’re registered for a GST/HST account – you need to register for this account separately. While it may not be mandatory to register for GST/HST, there are certain circumstances that would make it mandatory, based on how much revenue you are expecting in a calendar year and if you provide taxable goods and services.